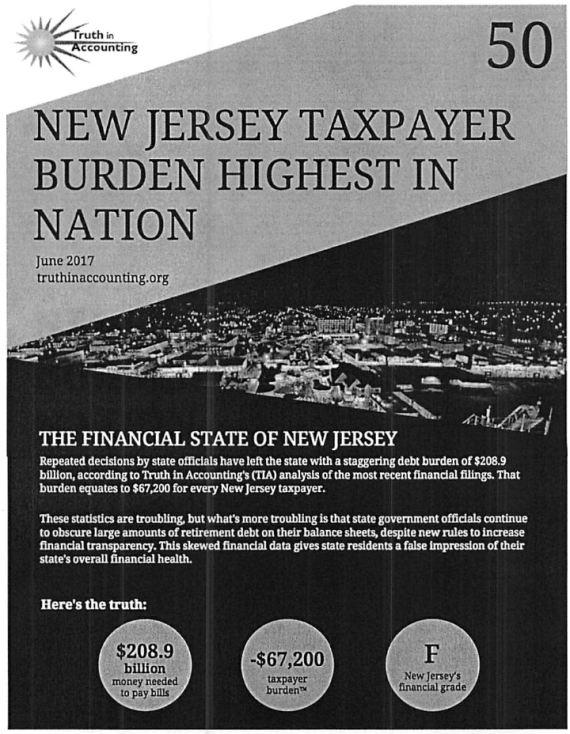

Truth in Accounting released a report today on the Financial State of the States based on data provided by the states.

New Jersey came in last based on the numbers but we have two, if not entirely unique at least exaggerated, burdens to bear here that put us in a much worse fiscal position:

- A property-tax cap that exploded local debt: To keep gravy trains fueled after a 2% tax-cap was enacted in 2010 localities looked to repay campaign bribes with debt that is now sinking Atlantic City with other cities (Roselle) about to follow.

- Our politicians: Unlike Illinois and Connecticut where politicians are struggling to find solutions (however misguided) to their pension crises, in New Jersey we have a fairly reasonable way forward gathering dust and key positions in government staffed with assholes and miserable pricks (per opening arguments).

Though tragic on its own, this is not the whole story:

Easy blog to get up as it mirrored what was put up one year ago today with only changes being the TIA updates and the Roselle bankruptcy progressing.

Posted by bpaterson on September 19, 2017 at 1:30 pm

just found out another NJ fist: we are fist in cases of lyme desease. so many high density over-developments chopping down trees, forests and greenscapes, the deer have nowhere to run so now traverse our neighborhoods at night.

Posted by Tough Love on September 19, 2017 at 2:33 pm

From this source, NJ has (as of 2014) about 205,000 full time State & Local Gov’t workers.

If you assume that the average wage for all full time workers is $80K the total wages paid all of NJ’s Public Sector workers is about $16.4 Billion.

Per Biggs AEI compensation study, ON AVERAGE for all (Non-Safety) workers combined the Public Sector has a 23% of wages total compensation advantage.

It’s like even greater, but lets call it 25% because the higher-paid/higher-pensioned Safety workers were excluded from that study.

That means that NJ taxpayers are UNNECESSARILY over-compensating it’s workers to the tune of about $16.4 Billion x 0.25% = $4.1 Billion annually.

*********************************************************************

While their current pension/benefit promises are ludicrously excessive and obscene, I don’t mind funding them if the money to do so comes DIRECTLY from a reduction in their now-oversized compensation.

We should immediately reduce annual compensation by that amount and apply that savings (and that savings ONLY) to their underfunded pensions.

Posted by Tough Love on September 19, 2017 at 2:35 pm

Source referenced above ……….

http://www.governing.com/gov-data/public-workforce-salaries/states-most-government-workers-public-employees-by-job-type.html

Posted by PS Drone on September 19, 2017 at 5:50 pm

You forgot that it is probably a good bet that the PS “work”force could be reduced by a third and no one, except those laid off, would notice.

Posted by Tough Love on September 19, 2017 at 10:05 pm

I couldn’t agree more !

Posted by Earth on September 19, 2017 at 7:12 pm

Earth to TL:

Too easy.

Posted by Anonymous on September 20, 2017 at 1:59 am

Here is your $4 billion

Not paid.

http://pension360.org/chart-a-history-of-new-jerseys-pension-payments/

Posted by Tough Love on September 20, 2017 at 2:54 am

Read the first 2 comments attached to THAT article.

Posted by MJ on September 19, 2017 at 2:40 pm

Sad…….

Posted by Tough Love on September 19, 2017 at 3:36 pm

John,

Thank you for posting that link ………. it should be required reading for EVERY NJ Taxpayer.

Click to access FinalFebruaryCommissionReport.pdf

Posted by George on September 19, 2017 at 6:15 pm

Off topic: New York State Constitutional Convention

More voters favor holding state Constitutional Convention: poll

http://nypost.com/2017/09/05/more-voters-favor-holding-state-constitutional-convention-poll/

I think this might be interesting because I saw some bumper stickers from Unions urging a no vote.

‘Convention’ a danger to pensions

http://www.uft.org/retired-teachers-chapter-news/convention-danger-pensions

IMO if the NY constitution is changed other states will need to consider it to remain competitive.

Posted by dentss dunnigan on September 20, 2017 at 9:47 am

Gee …we’re only # 2 for the best paid police in the country …http://www.app.com/story/news/investigations/data/2017/09/13/police-salary/657471001/

Posted by Anonymous on September 20, 2017 at 10:53 am

“The states who pay police the most are all among the most costly places in the country while those with the lowest average salaries are more affordable, according to the rankings.”

Logical

Posted by PS Drone on September 20, 2017 at 8:48 pm

Police do not bother me as much as firemen. Still occupying too many firehouses as if all the surrounding structures are made entirely of wood and there are no building codes. We could eliminate 75% of them if the “firemen” would be proactive and periodically ensure that everyone is equipped with fire extinguishers and smoke detectors instead of sitting on their asses watching football (and who knows what else).

Posted by Anonymous on September 20, 2017 at 12:07 pm

Hmm, how’d they do that?

http://money.cnn.com/2017/09/19/investing/norway-pension-fund-trillion-dollars/

Posted by Anonymous (NOT Earth. The other Anonymous.) on September 21, 2017 at 12:29 am

“And yes, Norway is one of the most heavily taxed countries in the world with a total tax burden of roughly 45% of GDP– almost 4x Hong Kong and nearly twice the US.”

Posted by S Moderation Honestly on September 20, 2017 at 12:11 pm

Truth on CA Fiscal State

I didn’t see this coming. Most people, I think, assumed KY, NJ, IL, PA, et. al., would be first to cut pensions, because funding levels are so low they will just run out of cash. Maybe they would provide the example of how to split the pot fairly. (Or a bad example.)

In CA though, some cities have withdrawn from CalPERS, and pensions were cut because PERS had to take the available funds and allot it to pensions using their risk free rates. Resulting in cuts of 50% or more. Those are cities that chose to withdraw.

It appears that, in the very near future, some local governments may be forced out if they simply can’t come up with the full ARC. Their pensions for existing retirees and current workers would have to be cut to accommodate the risk free rate. Assume any new/future employees would not be in the system at all.

Maybe when push comes to shove, somebody will be forced to find an equitable solution.

“But where shall wisdom be found?”

Job 28:12-28

SMH

Posted by S Moderation Honestly on September 20, 2017 at 12:13 pm

Posted by Tough Love on September 20, 2017 at 2:46 pm

I just read that article. It is INCREDIBLE how the Public-Sector-Union/Elected-Official cabal has successfully structured a “system” that not only provides ludicrously generous (and hence ludicrously costly) pensions, but has put in place “protections” so that no matter how dire the situation gets, those ludicrously generous promises can’t be reduced ….. even for FUTURE service not yet worked.

Well……….. it remains a MATH problem, and the math ALWAYS governs in the end-game.

And WHEN (not IF) the sh** hits-the-fan, those who reached retirement under such grotesque and unjustifiable promises (and think that their pensions are “inviolable’ as they like to say) will share the burden (i.e. material reductions) in an amount/percentage no less than those still active.

Posted by S Moderation Honestly on September 20, 2017 at 4:46 pm

NOT HERE!!! Says Tough Love. All we have here is HYPERBOLE and LUDICROUS “reforms” based on exaggerated ASSUMPTIONS.

It is not unusual to have different reductions for those already retired and those close to retirement than for newer and/or future employees.

And it is surely wiser to use logic instead of emotion. Math is fine, but it is just a tool, not a “governor”.

SMH

Posted by Tough Love on September 20, 2017 at 5:10 pm

No SMH, Not ludicrous REFORMS reforms, but ludicrous PENSION & BENEFIT PROMISES ……………. THAT being the ROOT CAUSE of the problem.

Quoting ………..

“It is not unusual to have different reductions for those already retired and those close to retirement than for newer and/or future employees. ”

And now YOUR greed is showing. You being one who has ALREADY retired, YOU want to be “protected”. How nice of you.

Posted by S Moderation Honestly on September 20, 2017 at 5:32 pm

Maybe this is part of your problem…

…$126,000 pension

…$110,000 pension

…$104,000 pension

Mary Pat Campbell…

“I’m not quoting these to get snippy about the $100K club – after all, I make more money than that and I don’t think that these are necessarily excessive amounts.”

I can’t find the quote now, but I believe I recall John has also said that he doesn’t care so much about the amount of compensation, but is much more concerned about the transparency and proper governance, and full funding for the promised pensions.

To be fair, I also get the distinct impression that John and Mary Pat also favor a DC plan rather than DB, mainly for the transparency and to reduce the temptation to finesse the system. I happen to disagree because I am not as cynical as John or as conservative as Mary Pat. There are still some prominent experts in the field who believe the advantages of DB system outweigh the disadvantages.

Perhaps your problem, TL, is you just don’t make enough money, or don’t know enough private sector workers who do.

SMH

Posted by S Moderation Honestly on September 20, 2017 at 5:55 pm

Yes, I did notice the word “necessarily” in Mary Pat’s quote.

I reiterate, even with their pensions, (and benefits) some public workers still earn less than or equal to equivalent private sector workers. How many, we may never agree on, but it doesn’t make sense to paint all public workers with the same broad brush.

For those who do earn less, their pensions are by definition not LUDICROUS. Ergo cutting everyone’s pension equally is not logical.

“It’s Not Unusual” is not just a Tom Jones song. Even some very conservative pundits believe that cuts should be limited to current employees, not those already retired. If you recall, I actually questioned that logic, as well as the concept of protecting those under an arbitrary minimum pension or those over a certain age.

Not GREEDY, Love… Moderate.

It’s not just a name. It’s a way of life.

SMH

Posted by Tough Love on September 20, 2017 at 8:12 pm

Quoting SMH,

“To be fair, I also get the distinct impression that John and Mary Pat also favor a DC plan rather than DB, mainly for the transparency and to reduce the temptation to finesse the system. I happen to disagree because I am not as cynical as John or as conservative as Mary Pat.”

No, YOU disagree because you exhibit the insatiable greed and the “entitlement mentality” rampant among Public Sector workers, and lack the necessary intelligence/understanding to see that Final Average Salary DB Plans simply CANNOT work in the Public Sector. Neither the insatiably greed Unions/workers nor our self-interested, vote-selling, contribution-soliciting Elected Official can be sufficiently changed (or trusted).

***********************************

Quoting SMH,

“I reiterate, even with their pensions, (and benefits) some public workers still earn less than or equal to equivalent private sector workers. How many, we may never agree on, but it doesn’t make sense to paint all public workers with the same broad brush. ”

I’m sure “some” do, but that’s not financially relevant. What impacts Taxpayers is the Public/Private Sector Total Competition differential FOR ALL WORKERS TAKEN TOGETHER, and per the Biggs AEI study, in BOTH CA and NJ the Public Sector workers * have a 23%-of-pay Total Compensation advantage.

Taxpayers……….. How much richer would YOUR retirement be if you had an ADDITIONAL 23% of pay to save and invest EVERY YEAR of YOUR career….. $500,000, $1 Million, perhaps $2 Million. Well, THAT is a good estimate of the amount that Taxpayers are UNNECESSARILY being FORCED to give (on average) every full Career CA and NJ Public Sector worker.

* The 23% excludes Safety workers, and with their MUCH greater average wages, and MUCH richer pensions, had they not been excluded from the AEI study, the 23% would have been materially higher.

Posted by Anonymous on September 20, 2017 at 3:29 pm

http://www.courier-journal.com/story/news/politics/metro-government/2017/09/20/kentucky-pension-crisis-plan-separate-louisville-workers/673802001/

Posted by Anonymous on September 20, 2017 at 4:59 pm

Isn’t this very similar to New Jersey? Local governments have been contributing their full ARCs, while the state has been shorting for decades. Will they all take the same cuts? Or will there be some (very) hard feelings?

Posted by Tough Love on September 20, 2017 at 8:21 pm

Yes, It’s the same way in NJ.

But (given the MUCH MUCH MUCH richer Local Public Sector pensions than those typically granted comparable Private Sector workers) what that really translates into is that for LOCAL Public Sector workers ………. even through their Plans are in the 70s% funded range (in the 50s% using the assumptions/methodology typically used in Private Sector Plan valuations) …………. Taxpayers have ALREADY contributed enough to fund WAY MORE than 100% of the Total Cost of a pension EQUAL TO what THEY typically get from their employers. As such, there is more than sufficient justification for Taxpayers to not to contribute another dime to the Local Plans.

Posted by MJ on September 20, 2017 at 5:54 pm

John

It is my understanding that none of this debt from bonding, borrowing, etc has been approved by NJ votes as mandated in the NJ state constitution. There is also at this time no provision in the NJ constitution that guarantees contributions for pensions.

I sit here and wonder why can’t his debt be repudiated and move on from there. Not sure what it would look like or what economic hardship it would cause but that would be an option………

Your thoughts?

Posted by burypensions on September 20, 2017 at 6:05 pm

Repudiation is not only an option in NJ (as there are very few fiscal laws, if they even exist, being enforced if it would be inconvenient) but a certainty.

Posted by Tough Love on September 20, 2017 at 8:26 pm

I wonder how many NJ Police Officers …… with their 4+ times greater-in-value-upon-retirement pensions (and have chuckled about about how they have so-suckered the Taxpayers) will read that ….. and gulp.

Posted by S Moderation Honestly on September 20, 2017 at 9:43 pm

I wonder how many NJ police officers in a few years will read in this blog that, due to underfunding, all NJ DB pensions will be frozen and all employees going forward will be on Social Security and a five percent DC match…

except safety workers. Just like so many before.

Not to worry. Going to DC for even the lowest half the employees might get your 23%.

That’s how irony works.

SMH

Posted by Tough Love on September 20, 2017 at 9:59 pm

You may well be correct (given history).

FWIW, for DC Plans to provide even a modest retirement (certainly NOTHING like the ludicrously generous pension now granted Police) you must save and invest perhaps 15% of your gross wages for 35-40 years. Most police in NJ RARELY work beyond 25 years (and then believe) that (usually starting in their mid 50s) that Taxpayers should support them for the rest of their lives.

There is ZERO reason they can’t work until their early 60s……….. there are LOTS of training and supervisory positions that do NOT require running down 20-year-old creeps. If they worked until 62, most would reach 35 years of service and a DC Plan (along with SS and personal savings) would work out just fine and put them in the SAME financial position as those those supposedly “work for”.

They should ALL participate in (and contribute towards) Social Security, and get taxpayer contributions towards THEIR retirement security EQUAL to what Private Sector Taxpayers get from their employers…… via a DC (NOT DB) Plan.

Yes, we appreciate them (as well as all honest, and hard-working Public Sector workers), but their is ZERO reason to over-compensate them … as we do now (in the extreme).

Posted by S Moderation Honestly on September 21, 2017 at 5:32 pm

“There is ZERO reason they can’t work until their early 60s……….. there are LOTS of training and supervisory positions that do NOT require running down 20-year-old creeps. If they worked until 62, most would reach 35 years of service and a DC Plan (along with SS and personal savings) would work out just fine and put them in the SAME financial position as those those supposedly “work for”.

With all due respect, you have no idea what you are talking about.

ZERO

SMH

Posted by Tough Love on September 21, 2017 at 11:24 pm

Quoting SMH………..

“With all due respect, you have no idea what you are talking about.”

Just saying so isn’t sufficient.

State your “opinion” WHY that is so, so that readers have the opportunity challenge your “opinion”..

Posted by S Moderation Honestly on September 21, 2017 at 11:54 pm

“there are LOTS of training and supervisory positions that do NOT require running down 20-year-old creeps.”

Quantify LOTS. Then back it up. You are making unsupported assumptions again.

Just saying so isn’t sufficient.

SMH

Posted by Tough Love on September 22, 2017 at 1:34 am

SMH, That’s not an answer, it’s evading this question.

Perhaps I should not have capitalized “LOTS”, but the readers get the point. In every occupation, as you go up the ladder with age and experience, your duties change and the dirtier more dangerous ones fall to the younger more agile workers. It should be no different in Police work.

Right now our Elected Official are either (a) hoodwinked into accepting that all cop should be retired on the taxpayers’ teat by age 55, or (b) simply BOUGHT-off with Public Sector Bribes disguised as campaign contributions, to go along with Union wishes.

Posted by Earth on September 22, 2017 at 3:49 am

Earth to Tough Love:

Posted by S Moderation Whatever on September 22, 2017 at 2:35 am

LMAO

Evading a dumb question. You made your usual wild accusations and have no idea what goes on in the police organizational structure. Now you’re back to your bought off/hoodwinked officials. More unsubstantiated accusations.

” Just saying so isn’t sufficient.”

Here’s a clue… Some off those boxes at the bottom will work their way up a step or two. One might make it all the way to the top. (He’ll have a better chance if those above him retire at 55.)

Many/most of those at the bottom will stay at or near the bottom. It’s math.

SMH

Posted by Tough Love on September 22, 2017 at 4:35 am

LOL …………… so we (the Taxpayers), should let Police retire so young (and pay so much for it) …… NOT because it’s NECESSARY …. but because it makes room for those below to advance ?

Really?

You such an idiot.

Posted by dentss dunnigan on September 22, 2017 at 10:17 am

TL what the police unions have done is compressed a 35 year pay scale into 20 years .When a policeman reaches 55 ( or 20 years ) they argue they can no longer perform their duties as well as a younger cop . Now the rest of that is do you really want to pay someone in the last 10 years the top pay scale to do office work till he’s 65 . and you know they will never agree to lower pay after making 100+ K …so what’s the answer ?

Posted by Tough Love on September 22, 2017 at 11:55 am

The problem is in your words …. “what the police unions have done is compressed a 35 year pay scale into 20 years ”

And who says that Taxpayers must agree to that ?

SMH is always saying that we should look at “Total Compensation” (and I agree). Right now where I live in NJ, Police Total Compensation is LUDICROUS (and I’m not throwing that word in for effect). The LOWEST rank officer with just 5 years of service has a base pay of over $135K and with (properly valued ….using the assumptions/methodology required of Private Sector Plans) pensions & benefits included, has a total comp package worth over $200K.

Its not the wages that make it ludicrous, it’s the pension & benefit package, and I’m convinced that few (VERY VERY few) truly understand the cost of granting someone 70%* of final (already high) pay (COLA-increased if NJ current suspension of COLA is lifted) staring in their mid-50s.

The number of companies still crediting pension accruals under Final Average Salary (FAS) DB Plans has dropped to a VERY low % because they are simply too costly to properly fund and too “risky”. And the few that still do, use formulas with MUCH lower (than Police Plan) per-year-of-service “formula factors” and typically reduce the otherwise-calculated pension by about 5% for EACH year of age that you begin collecting that pension before the Plan’s Normal Retirement Age (typically 65). The higher Police-Plan formula-factor combined with the lack of ANY reduction in payout associated with beginning to collect one’s pension at age 55, makes NJ Police pensions just about 4 times greater in value upon retirement than that of the Private Sector worker (lucky enough to still be participating in a FAS DB Plan) who retires at the SAME age, with the SAME wages, and the SAME years of service.

If you asked an intelligent group of NJ residents (not biased via employment in Police families) if due to the nature of the job they the felt that Police should get a larger pension than a similarly situated (in wages, age at retirement, and years of service) Private Sector worker (and if yes, by what percentage), I believe most would say yes (myself included), suggesting 10%, 25%, and some even 50% greater ….. but I believe nobody would even come remotely close to the 4 TIMES greater-in-value pensions that POLICE are granted RIGHT NOW.

And that is LUDICROUS.

* often 90% and COLA-increase in the even MORE-ludicrous pensions granted in CA ………. often resulting in Police pensions 5 to 6 times greater in in value than those of comparably situated Private Sector workers.

Posted by S Moderation Honestly on September 22, 2017 at 12:13 pm

Actually, you’re getting close. Snide though you may be. A common pension plan on the east coast is “twenty and out”. Half of final pay after twenty years at any age. Plus healthcare for life. (Yes, just like the military.) It keeps the average age younger, especially for street officers.

Seeing as how real people are all different, not like numbers on a spreadsheet, many very fine patrol officers are just not suitable for management positions or other desk jobs. Some can stay past twenty, either in management or if physically and emotionally fit, still on the street.

Either way, twenty and out, or 80-90 percent at fifty keeps the average age of the force younger. (Yes, just like the military.)

You such a… whatever.

SMH

Posted by Tough Love on September 22, 2017 at 12:50 pm

In NJ, Police pensions are 50% @ 20 years, 65% @ 25 years, or 70% @ 30 years, so MOST leave after 25 years, THAT being the best deal.

Like the military?

With few exceptions (Newark, Paterson, Camden, a few other place) the majority of NJ is bedroom communities with little crime …………… and our Police function NOTHING like the military. The comparison is absurd.

Posted by S Moderation Honestly on September 22, 2017 at 1:53 pm

Depending on your definition, fewer than ten percent of military are deployed in overseas military operations, and only ten percent of those actually see combat. More than half the military are stationed inside the continental U.S.

They often receive valuable occupational training and experience in the military, and sometimes receive a college education in the military, or are subsidized for college after discharge.

Many ex or retired military even become… Police officers.

SMH

Posted by Tough Love on September 22, 2017 at 3:45 pm

I have no problem with America’s military pay or pensions (and neither I nor any family member now do or will benefit from either).

It’s State & Local Public Sector worker pensions & benefits …. ESPECIALLY for Safety workers ……… that are ludicrously excessive …………. routinely 4 TIMES (6 times in CA) greater in value upon retirement than those of comparably situated Private Sector workers..

And that is ON TOP OF wages that ALONE (often $135K+ BASE PAY after just 5 years of service for the lowest rank) are VERY difficult to justify in NJ.

Posted by Barbie Jenkins on September 23, 2017 at 11:39 pm

Most police officers get their job because they know someone in a political office – not because they served in the military. The police director finds ways to pick apart veterans over insignificant things , so the police officer jobs go to their blood relatives or family friends who may have even worse criminal or motor vehicle records.

Posted by S Moderation Honestly on September 22, 2017 at 5:18 pm

Good for you. But the point was, earlier retirement helps keep the average age of active duty military lower. Earlier retirement makes room for more younger recruits. Same with public safety workers.

Posted by Tough Love on September 22, 2017 at 5:34 pm

Boy, you STILL don’t get it ………….

It’s NOT in the Taxpayers’ best interest to …. “make room for more younger recruits.”

It in their WORST financial interests.

Posted by Tough Love on September 22, 2017 at 5:35 pm

AND, not “necessary” for effective Public Safety.

Posted by S Moderation Honestly on September 22, 2017 at 5:56 pm

You forgot to say…

Posted by Tough Love on September 22, 2017 at 8:18 pm

No, in the opinion of anyone who is not (or doesn’t have a family member who is) sucking at the Taxpayers’ teat.

Posted by Earth on September 23, 2017 at 3:25 pm

Earth to Tough Love:

Your post does nothing to substantiate. It’s just your “opinion” of other peoples opinions. Or a thinly veiled excuse to say “sucking at the teat” again. How puerile.

Posted by Tough Love on September 23, 2017 at 6:36 pm

Feeling down SMH ?

When you can’t come up with any reasonable response you bring out your alter ego and post under “EARTH” ?

Posted by Barbie Jenkins on September 23, 2017 at 11:42 pm

The military often forces out lower level men before 20 years just so they can’t get a pension. And no comparision – military people put their life on the line every day – police officers not as much – many police fficers in NJ never fire their gun their entire career.

Posted by MJ on September 25, 2017 at 11:51 am

But that’s part of the problem at least with the police…..they retire in their 50s and then younger officers still need to be hired to replace them…..the retirees can and do live well into their 80s so the retirees keep piling up with their generous pensions, health care and pay outs while city and municipality finances are in the gutter and getting worse every budget year.

I don’t have a problem with city cops (Newark, Camden, Los Angeles, etc) I think t hey deserve every penny and should retire in their 50s but these bedroom community cops??? Come on now…………

Sorry SMD, although you make some good points, there is just no way this system is sustainable

Posted by Tough Love on September 25, 2017 at 3:34 pm

MJ,

It’s NOT just ….”they retire in their 50s and then younger officers still need to be hired to replace them”

That’s a BIG PART of the problem, but the other 2 BIG parts are:

(1) that the formulas them selves are grossly excessive, for full-career officers, typically replacing 70% to 90% of final wages, and

(2) Include COLA increases (now suspended in NJ) ………. which are almost never included in Private Sector pensions ……….. which increases an otherwise identical pension by about 1/3 for workers who retire in their mid 50s.

Posted by PS Drone on September 25, 2017 at 5:40 pm

I have always called it the “Grandfather, Father, Son” principle (borrowed from software development logic): Grandpa LEO has been retired and living on the public teat for 20 years; Father just retired after a bruising 20-year career and Son just started walking (more likely driving) a beat. Hence 3 drones on the payroll for one effective LEO. That is how it is done in the world of LEO and Firemen.

Over soon though.

Posted by Tough Love on September 25, 2017 at 8:10 pm

PS Drone, you missed something…………..

The LARGE % of retired Police and Firemen that retire with phony “disability” pensions.

Posted by Anonymous (NOT Earth... the other Anonymous) on September 23, 2017 at 7:23 pm

The interweb judges have ruled that the statement “No, in the opinion of anyone who is not (or doesn’t have a family member who is) sucking at the Taxpayers’ teat.”

Does not merit a “reasonable response”.

Please refer to Hitchens’s razor…

“What can be asserted without evidence can be dismissed without evidence”.

Posted by Anonymous (NOT Earth... the other Anonymous) on September 23, 2017 at 7:28 pm

Catchy: I wonder if anyone else has used it yet as a handle?

Is it available?

Posted by Tough Love on September 23, 2017 at 10:49 pm

Quoting from Mr. Bury above……………

“Repudiation is not only an option in NJ (as there are very few fiscal laws, if they even exist, being enforced if it would be inconvenient) but a certainty.”

Sleep well tonight O’ Public Servants.

Posted by Anonymous on September 23, 2017 at 11:30 pm

“It is your concern when your neighbor’s wall is on fire.”

Horace

Repudiation will not occur in a vacuum. It will affect the economy of the entire state.

Lose/lose.

Posted by Tough Love on September 24, 2017 at 1:02 am

NJ’s Taxpayers have ALREADY contributed an amount sufficient to fund 100% of a pension EQUAL TO what THEY typically get from their employers.

Public Sector workers deserve EQUAL but no more, and Taxpayers should not fund more.

NJ’s promised Public Sector pensions are NOW 2 to 4 times greater in value upon retirement than those of COMPARABLY situated Private Sector workers, and the result of the Public Sector Unions’ BUYING of the favorable votes of our self-interested, vote-selling, contribution-soliciting Elected Officials with BRIBES disguised as campaign contributions and election support.

In any other venue, such actions would be considered racketeering and bribery.

************************************************************

Taxpayers, REFUSE to fund these ludicrous “promises”. The Plan participants should tar and feather those who made promises they KNEW could never be kept, as well as their Union officials who thought it was ok to do so,

Posted by S Moderation Honestly on September 25, 2017 at 12:16 am

“NJ’s promised Public Sector pensions are NOW 2 to 4 times greater in value upon retirement than those of COMPARABLY situated Private Sector workers,…”

Except for the Teamsters, of course. And any others we may find in the future.

SMH

Posted by Tough Love on September 25, 2017 at 12:27 pm

As I have stated very clearly to YOU several times, my comments with respect to Private Sector Plans refer to Single-employer Corporate-sponsored Plans (including those of Fortune 500 Companies), not the FAR fewer Multi-employer-Union Plans (many of which are now sinking into the abyss).

Posted by S Moderation Honestly on September 25, 2017 at 4:50 pm

Indeed you did.

Single employer plans cover about 30 million workers. Multi-employer covers about 10 million..

1) Why do you ignore 25% of pensioners?

2) Public pensions are public knowledge. Have you ever given a link to data for private sector pensions to substantiate your ” 2 to 4 times greater in value upon retirement” claim?

SMH

Posted by Tough Love on September 25, 2017 at 8:02 pm

SMH,

I’m not “ignoring” Multi-employer/Union Plans, It’s just that I know much less about them than Public Sector Plans and Private Sector Single-employer Corporate-sponsored Plans……… and I prefer to comment on things/issues that I am knowledgeable (and yes, FAR more so than you ….. and w/o the vested interest in the status quo that you have as a Public Sector retiree now collecting a pension).

What I do know about multi-employer Plans is that they often do include 30-year & out provisions which enables retiring in your 50s (if you start working at a young age), and just like Public Sector plans, actuarially unreduced payouts beginning in the 50s vs say 65 can DOUBLE the cost of the benefits provided.

*************************************

I’m sure the Actuarial firms that value Private Sector Plans have data on common Private Sector DB Plan formulas & provisions (for comparison with Public Sector Plans) but Googling for such a summary of such data has not been forthcoming. Perhaps you can find a such a summary.

John ……… can you provide a link to such a summary ?

I have provided numerous mathematical demonstrations in comments on this Blog (using formulas/provisions that I know to be common to Private Sector DB Plans still crediting benefits today) that show that Public Sector pensions are ROUTINELY 2 to 3 times (4 to 6 times for Safety workers) greater in value upon retirement than those of Private Sector workers who retire at the SAME age, with the SAME service, and the SAME wages.

In fact, you have acknowledged that you can find no errors in by math ……. but object to a comparison of just PENSIONS.

I have agreed with that as well, MANY TIMES calling for equal “Total Compensation” (wages + pensions + benefits). Which of course leads us back to Biggs AEI study, wherein it concludes that in both our home Sates of NJ and CA Public Sector workers have a 23%-of-pay Total Compensation ADVANTAGE ………. an ADVANTAGE that:

(a) excludes what Biggs estimates to be an ADDITIONAL 10% of pay advantage due to the MUCH greater Public Sector job security, and

(b) would be even greater (than the 23%) has the Biggs study not excluded Public Sector Safety workers who have the highest average wages and the richest Public Sector pensions.

Posted by S Moderation HonestlyH on September 26, 2017 at 3:55 am

Déjà pu…

I never questioned the math because it was/is irrelevant. You prefer to comment on things you are knowledgeable about?

And what? Ignore any you know nothing about? Like private sector doctors with very generous DB pensions? You realize that pensions outside the context of total compensation is meaningless, but you keep doing that “math”.

Stop me if you’ve heard this, but you have an unnatural obsession with “23%”. Biggs study was very enlightening for several reasons, but it was one of many conflicting studies all subject to data error, differing assumptions, bias, and all dated.

We don’t know what kind of company you work for, but surely today you wouldn’t use financial data 5 to 9 years stale as if it were still current. It’s laughable. And there is good reason to believe the study was unrealistic even when it was written.

#23%bulls hit

SMH

Posted by Tough Love on September 26, 2017 at 1:40 pm

Quoting SMH …….. “Like private sector doctors with very generous DB pensions? ”

I challenge you to show the readers statistics that support that claim ……. clearly suggesting that it is widespread…………. more of your attempt to mislead.

As a % of all Private Sector doctor, those with Final Average DB Plans of the type granted almost all Public Sector workers, I would be very surprised if the % is even 5%, and considerably lower if you exclude those in small practices that 100% fund them with THEIR OWN money..

Quoting SMH…………

“You realize that pensions outside the context of total compensation is meaningless, but you keep doing that “math”.”

I disagree. In NJ, most residents would agree with me that a typical $135K annual BASE PAY for the lowest rank officer with just 5 years of service is unnecessarily high BY ITSELF. It is VERY instructive to DEMONSTRATE that on top of that, NJ officers are getting a pension 4+ times greater in value upon retirement than what THEY typically get, as well as free or low-cost retiree healthcare.

Knowledge is GOOD ….. except for those trying to hide something.

Posted by Earth on September 26, 2017 at 8:11 pm

Earth to TL:

“I challenge you…”

LOL!

You are a veritable found of disinformation.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Posted by Tough Love on September 26, 2017 at 9:04 pm

Feeling down again SMH ….. and no effective way to respond ?

So you’re posting under your alter ego….”EARTH” ?

********************************

Like I stated above …………..

Knowledge is GOOD ….. except for those trying to hide something.

Posted by Earth on September 27, 2017 at 4:42 pm

A wise man once said of “knowledge”.

Posted by Tough Love on September 27, 2017 at 5:00 pm

And ………….A light-bulb-changer wants us to believe that knowledge isn’t important.

Posted by Fiscal State of the States | Burypensions Blog on September 26, 2018 at 4:17 pm

[…] Jersey may have even cheated to get that ‘F’. Last year the debt numbers were worse with the Unfunded pension benefits being $15 billion higher. Could this […]