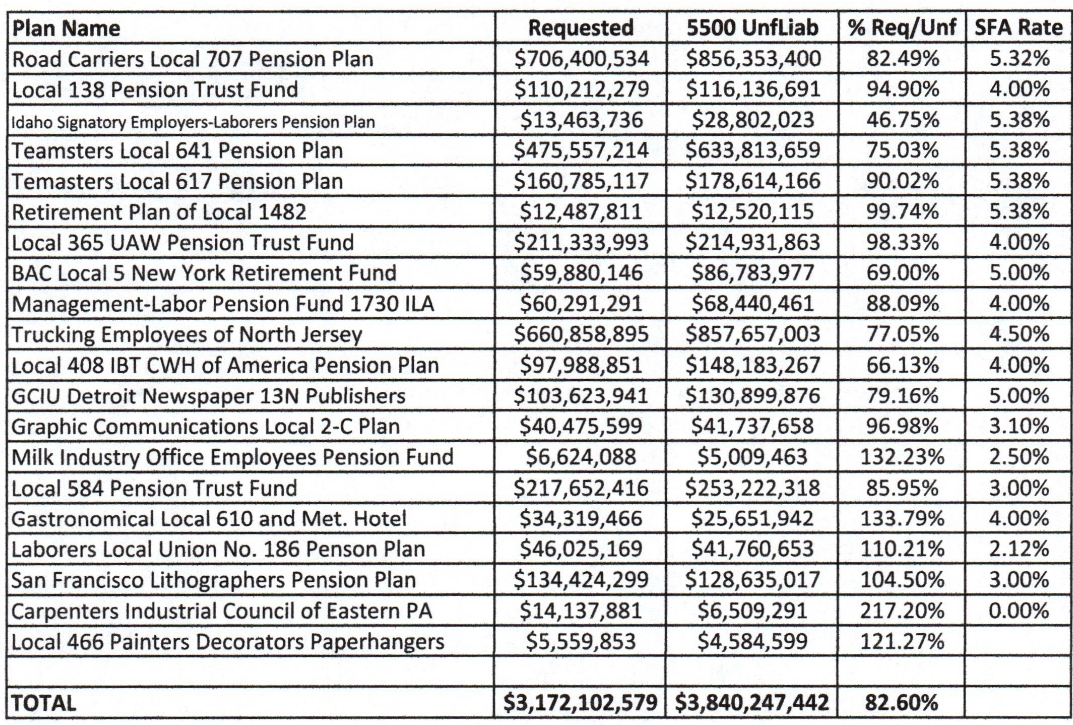

The Carpenters Industrial Council of Eastern PA Pension Fund is asking the government for $14,137,881 under the multiemplolyer bailout program. Template 4 of the application is where the requested amount is calculated. The PBGC provides that template and here is what I get from making up my own sheet* using the plan’s data with a 5.38% assumed interest rate for future earnings instead of 0%.

$8,108,586 would be 123.19% of RPA unfunded liabilities which is in the upper range of what other insolvent plans are asking though the PBGC might well approve the extra $6,119,295 in payments if they believe that 0% is a valid interest rate** to use for estimating future earnings.

.

.

* Incidentally, these applications are easy to make up. They may run hundreds of pages but almost all of it is backup data with the meat being two excel spreadsheets, one estimating future payouts and the one above projecting what it will take to get the trust to $0 by 2051. And the PBGC gives you the worksheets. Excel and PBGC do most of the work.

** More blogs coming on this as it develops but for any pension actuaries out there: have you ever used 0% for your valuation interest rate? I only looked at 2019 MBs and nobody did but this one plan. The rate may have been blank on 6 of the forms but those looked like typos and this was the only plan that meant to use 0%. The other 1,200 all had a rate of at least 2.92% all the way up to 8.5%.

Posted by Ray Shorter on November 10, 2021 at 8:05 pm

They’re asking, paper work is in, and yet there’s no approvals. That 120 day mandate must be etched in stone. To bad this crisis isn’t looked at like the stimulus checks.

Posted by burypensions on November 10, 2021 at 8:39 pm

I agree. It is too bad this isn’t covered at all. If there is an article (outside of here) on these SFA payments I would be curious to see it.

It’s government SOP. Wait until the deadline and there is still a chance, like the IRS, that when the 120 days approach the PBGC can ask for more time for the filer. As it is the 707 clock reset.

Posted by Stephen Douglas on November 10, 2021 at 9:28 pm

Very little on public sector pensions, also. The blogs and Facebook pages are drying up and blowing away. Just usurped by Covid?

Posted by geoxrge on November 11, 2021 at 8:27 am

“120 day mandate”

August 13, 2021 + 120 days is Saturday, December 11, 2021

August 13, 2021 + 120 business days is Wednesday, February 9, 2022

Does amending an existing filing reset the 120 day clock?

August 13, 2021: Breaking News: First SFA Filing

No mention of Butch Lewis act but:

Manchin may delay Biden social spending plan over inflation

https://www.yahoo.com/news/manchin-may-delay-biden-social-012550136.html

Posted by Stephen Douglas on November 11, 2021 at 11:06 am

Joe who?

If you line up all the economists in the country, they will all be pointing in a different direction.

In 2008, gas was over $4 gallon in California. By 2009 it was a out half that.

Inflation rate dropped from 5% to zero.

Fixed it! /s

Who cares what Manchin thinks?

(autocorrect doesn’t like man chins name)

Posted by Stephen Douglas on November 10, 2021 at 10:35 pm

Leo Kolivakis is still going strong. Daily, I think. From a May 06, 2020 column: (Pension Pulse)

“I recently wrote a comment warning my readers that US pension bailouts are coming. There are many chronically underfunded US public pensions which will not come out of this crisis unscathed.

Somewhat controversially, I stated the following:

And remember what I keep telling you, pension bailouts are all about bailing out Wall Street which includes big banks and their big private equity and hedge fund clients that need perpetual funding.

It has nothing to do with bailing out pensioners but politicians will make it look that way.”

Does that apply to private sector bailouts also?

Posted by Ray Shorter on November 11, 2021 at 12:26 pm

Why should 707 pay for bad direction? The money is there to rescue pensions, why isn’t anyone in power upset that the money isn’t being used? Pensioners are literally dying waiting on pension restoration and backpay. Where’s the compassion?

Posted by aon12345 on November 11, 2021 at 3:14 pm

While techincally the 707 clock reset – it is doubtful that they will be delayed much at all since the filing has already been reviewed and the PBGC certainly does not want to delay it anymore.

Posted by aon12345 on November 11, 2021 at 3:17 pm

Mr Bury – it is rather comical that you believe this fund could earn 5.38% on money invested solely in high quality corporate bonds. You seem compelled to show this community how incompetent you are.

Posted by SFA Update – Three More Approvals | Burypensions Blog on May 3, 2022 at 2:31 pm

[…] The PBGC Special Financial Assistance program for troubled multiemployer plans approved three more plans for bailouts including the one that used a 0% valuation interest rate on their Schedule MB. […]