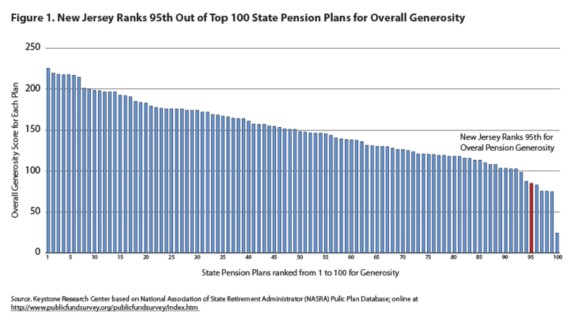

The Star Ledger Editorial Board asserted that “NJ Pensions are stingy, not generous” and they backed it up by citing:

Of the 100 largest public pension plans in the country, we rank 95th, according to a careful study by New Jersey Policy Perspective [NJPP], a liberal think-tank with the motto “Facts Matter.”

That study included this chart:

Notice no identification of the other plans in that chart? Who was that outlier short straw at the far right and which plan was the most generous according to the NJPP way of thinking?

It doesn’t matter since the idea was to get us all thinking that benefits under the New Jersey public pension system should not be cut since they are already stingy, however slipshod the evidence. Using the NJPP methodology New Jersey would be ranked 8th in generosity among those 100 plans were they to provide NO pension at all to their employees.

But why would the Star Ledger Editorial Board jump on board this propaganda train so easily. It’s as if they had written the report themselves. Well…..

According to the NJPP website their newest staff member is:

Carly Rothman Siditsky, Development Director, joined NJPP in September 2014 from The Star-Ledger, where she most recently served as Director for Social Media. Previously, Carly was a member of the Star-Ledger editorial board, the online editor for opinion and a reporter and web editor covering topics ranging from local politics to health to Hurricane Sandy.

The latest form 990 filed by NJPP does not list donors but one can assume that those who give them $478,777 annually have an interest in seeing the narrative convenient to their interests corroborated, if only by themselves and their money.

Posted by Tough Love on December 27, 2014 at 8:51 pm

And of course, nary a mention that this “study” compared NJ pension Plan generosity ONLY to other “PUBLIC” Sector pension Plans …. while it’s NJ’s PRIVATE Sector Taxpayers supposedly on the hook to pay 80-90% of these Plan’s total costs.

Give that some thought ……

If we tripled the generosity of ALL Public Sector Plans in this study ….likely bringing the TYPICAL level of generosity to 10 times that of the typical Private Sector pensions (Yup, thats true) …… the study conclusions would not change one bit.

When you have an “agenda” and little ethics, distorting the truth is not difficult.

Posted by Tough Love for Tough Love on December 27, 2014 at 9:26 pm

Happy Holidays Tough Love, oops

Pardon me Ebenezer. Ho Ho Ho, who cares about

Those contractually made obligations! Abrogate them!

While your at it abrogate any contracts made to me either.

Merry Christmas/bah humbug. TL, still feel like walking out on your meal,

Now that the bill is due? But you are the food and are mad at your elected

Representatives who spent the monies to be used to pay the contractual obligation.

Bit of sour milk since some of those monies came back to you in homestead rebate checks, Ho Ho Ho.

The contracts are. Taxes need to be raised for the services you’ve already received. Benefits will need to be cut to a degree. The obligation of contact. Generational fairness. A solution needs to be found to honor the promises made to both groups. Skipping out on the bill is morally bankrupt. Ho Ho Ho.

Posted by Tough Love on December 27, 2014 at 11:12 pm

Yup, those “those contractually made obligations” …. made in COLLUSION between your Unions and our elected officials BOUGHT-OFF with Unions campaign contributions,election support, & block voting, with NOBODY looking out for Taxpayer-interests ………..Abrogate them!

Happy new years, Public Sector “moocher”.

Posted by Anonymous on December 28, 2014 at 12:36 am

Shut your pie hole, millionaire who doesnt want to pay her fair share of taxes!

Posted by Tough Love on December 28, 2014 at 12:38 am

Tis the Season of “giving”, not being a “moocher”.

Posted by skip3house on December 27, 2014 at 10:41 pm

This ‘study’ by Stephen Herzenberg, Executive Director of the Keystone Research Center

Posted by Anonymous on December 28, 2014 at 1:00 am

Be fair everyone. TL received his services over the last 20 years and now he doesn’t want to pay his check, LOL. TL, I know that the conspiracy theory about you being a victim this whole time and not having a say, justifies your position (to you) but at the end of the day….if you disagreed at the time, why didn’t you object to the contracts then? Why didn’t you run for office, campaign for someone who would be ‘tougher’ the reason you didn’t object because you were OK with it at the time. Now the fiscal environment has changed you want to skip out. Hey everyone, I think we should promise TL he can vent on this site in 10 years. We’ll promise you that we won’t impine your rights. Trust us when the time comes we will hold up our end. Bah humbug. I would love to hear a solution from TL that discusses bridging contractual rights and generational fairness without being morally bankrupt.

P.s. Care to share which side of the public private fence you sit on or are you retired or SE? courage 2? I’ve already told you I’m private even though you seem to have forgotten.

Posted by Anonymous on December 28, 2014 at 1:04 am

He is a she but I think she likes shes. She does not the have the compassion of a woman who likes men.

Posted by SDouglas47 on December 29, 2014 at 1:15 pm

That explains a lot.

Thanks

Posted by Tough Love on December 28, 2014 at 1:08 am

Come on now, let’s be honest………..

Your Unions have BOUGHT your way to pension promises* that are TYPICALLY 3-4 times greater in value at retirement than those of your Private Sector counterparts, and with ALL of your own pension contributions (including all the investment earnings thereon) accumulating to a sum at retirement sufficient to buy 10-20% of that GROSSLY EXCESSIVE pension promise.

And you think it’s “fair” and “just” for Private Sector taxpayers to pay 80-90% of a the cost of a pensions 3-4 times greater than what THEY typically get?

On what planet do you live on ?

————————————————-

* I said “pension promises”, not “pensions” …. because we (the Taxpayers) have absolutely no intention of honoring such dishonestly obtained “promises”.

Posted by Anonymous on December 28, 2014 at 1:20 am

Besides the impact to your taxes, the bigger reason that the pension issue within the individual states matters, is that at this time it’s a chance to test out these types of screw your neighbor policies to a minority. A minority/Public employees who number fewer in the grand scheme and are of a particular voting block. The real prize and goal of these political (yes political) hate your neighbor mechanations is social security. It is in the same position, more money going out than coming in, the shortage coming out of the general fund (the trust fund is technically empty). The choices made around how we honor the promises made to those who have worked and are retired/held up their end, in the end will dictate how a generation gets taken care of. (TLs victim fantasy aside) I don’t disagree that public employee negotiations need to be at a county level.

Posted by Tough Love on December 28, 2014 at 1:33 am

(A) Quoting …”The choices made around how we honor the promises made to those who have worked and are retired/held up their end, in the end will dictate how a generation gets taken care of. ”

So let’s see … Social Security recipients (on average) get back a wee bit more than they & their employers contributed, at a very modest earnings rate, with those near the maximum wage base barely get back the dollars they contribute….. while Public Sector workers TYPICALLY getting back $5 to $10 in pensions for each $1 THEY contribute, with Safety workers often getting 10-20 times their contributions.

Which need fixing ?

(B) there should be no “negotiations” with Public Sector Unions at the State, County, or Local levels. Public Sector Unions are a CANCER inflicted upon civilized Society.

Posted by hondo on December 28, 2014 at 5:07 pm

The entire General Assembly is up for re-election in 2015. If the Unions are a cancer, wall street billionaires are the primary site! NJ Unions will support candidates who will protect our pensions!

Posted by Tough Love on December 28, 2014 at 6:20 pm

Hogwash … simply your attempt to “distract” attention from the ROOT CAUSE of NJ’s financial woes …. GROSSLY EXCESSIVE Public Sector pensions & Benefits.

Posted by skip3house on December 28, 2014 at 9:55 pm

‘Woes’…AND, the cruel regressive school property tax on homes

Posted by Tough Love on December 28, 2014 at 10:39 pm

Our “beloved” safety workers’ completely ridiculous pay, pensions, and benefits (at least in NJ’s many low-crime suburban communities) deserve a large part of the blame for that…………. and of course the VERY small State pick-up of school costs, THAT TOO because, due to the grossly excessive pensions & benefits promised all State workers, it has little funds to pass-along to Local School Districts.

We MUST very materially cut or simply renege on these absurd pension/benefit promises …. for all CURRENT workers.

Posted by skip3house on December 28, 2014 at 10:53 pm

Perfect, far as it says here. Just also replace the school property tax with about another 80% (less any savings on Abbott) income tax. Right now, I understand NJ Income tax and School property tax are about equally supporting the NJ School system, ~$$24Billion each, or in total?

Right on with abuses, promotions from low hours/pay to high full time just before retirement, free retiree medical, even for those on ‘no show’ committees,…..on and on

Posted by Tough Love on December 28, 2014 at 11:18 pm

skiphouse, your last item is particularly abusive … the practice of many political-types (councilman, committee members/appointees, etc.) building many years of Service-credit in NJ’s pension systems with little pay and few hours, and THEN, using their connections to land a well-paid full-time job for 3 years, yielding a pension no different than had they been a full-time, full-career worker.

The Private Sector makes such abuse almost impossible, by NOT setting an easily-met minimum pay level to accrue a year of pension service, but by requiring 1,000 documented hours of paid service in each year.

The ONLY reason NJ’s legislators won’t move to such a definition (for a year of service credit) is that that WANT TO continue to be able to rip off the Taxpayers.

This is simply one of the MANY reasons why I call for Taxpayers to renege on ALL of these absurdly generous Public Sector pension/benefit promises.

Posted by Anonymous on December 29, 2014 at 8:08 pm

It doesn’t matter who gets elected the math stays the same…….there is no logical or reasonable way to pay for the excessive pensions and benefits. There is NO money in the budget!!

Posted by Tough Love on December 29, 2014 at 9:16 pm

I agree only partially. While the pension “math” indeed stays the same Republicans certainly aren’t as beholden to the Public Sector Unions for votes, and hence are likely more willing to TRULY address the HUGE financial problem we are in.

Clearly that problem has as it’s ROOT CAUSE the grossly excessive pensions & benefit promised all Public Sector workers (both STATE and Local), and “addressing” the massive underfunding of their pensions (and almost complete lack of funding of their retiree healthcare promises) will involve great financial pain for SOMEBODY.

And there are ONLY 2 “somebodies” …. the Taxpayers and the Public Sector actives/retirees that have been promised these grossly excessive (by ANY and EVERY reasonable metric) pensions and benefits.

My guess …. modest tax increases, massive reductions in promised retiree healthcare benefits for BOTH actives and current retirees, significant FUTURE Service reduction for bot NEW and CURRENT workers, and likely, modest pension reductions for those already retired.

Happy Holidays !

Posted by hondo on December 28, 2014 at 8:37 pm

HAPPY NEW YEAR!

Posted by pat on December 29, 2014 at 3:40 pm

I am a 33+ year state-worker who would gladly give up my “guaranteed” pension income so the rest of the still-working class can refinance/expunge their legal obligations and financial duties. Yeah, ok. lol. idiot

Posted by Tough Love on December 29, 2014 at 4:23 pm

Do you mean that grossly excessive “guaranteed” pension negotiated in collusion between your Unions and the elected officials they bought-off (with campaign contributions and election support) … and with nobody at that “bargaining table” rightfully looking out for Taxpayer-interests ?

Posted by Anonymous on December 29, 2014 at 4:11 pm

To answer one of your questions – “The least generous pension plan by far, with a score of 24.5, covers municipal employees in California’s Contra Costa County. The pension plan ranked 99th, the New Hampshire Retirement System, received an overall generosity score of 74.5, not far below New Jersey’s 85.”

What do you think about the dataset?

Posted by How Stingy is NJPP’s Least Generous Public Pension Plan? | Burypensions Blog on December 29, 2014 at 11:54 pm

[…] « Creating Your Convenient Narrative […]

Posted by Raise Taxes Quoth the Inane | Burypensions Blog on February 17, 2015 at 10:06 am

[…] reference to a silly NJPP study that sought to propagandize public pension benefits in New Jersey as […]

Posted by Lies, Incorporated with a NJ Pension Example | Burypensions Blog on May 13, 2016 at 12:00 am

[…] Rosenstein picking up on an NJPP lie: . . And that participants pay for 75% of their pensions: . . If that were true then why do the […]

Posted by Danger of Trusting Actuaries | Burypensions Blog on March 15, 2019 at 7:44 am

[…] let’s scrap the defined benefit pension and give each teacher $2,837 a year. . . Obviously ridiculous and it all comes from trusting public plan actuaries, which I have warned against, and your own prejudices as abetted by bought ‘research’. […]

Posted by skip3house on March 15, 2019 at 9:57 am

……..who are the people who promised, then not taxed/funded, since ~1990, all these pension/Rx costs? Let’s hear from them, if alive even. Who approved increases of benefits, in worker benefit documents, w/o funding stream? From current news/speculation mostly, would threat of legal action help? Were hiring/paying workers even honest actions if benefits went unfunded?

Facts are evident under-funding was purposeful, not from ignorance, but to kick the can to present generations for services performed before, well into our past.

Posted by Union Propaganda Backfire | Burypensions Blog on September 17, 2019 at 7:44 am

[…] 2014 they came out with a report (easily refuted) that claimed “New Jersey ranks close to last for overall pension benefit generosity, at 95th […]

Posted by NJEducationAid: NJ Policy Perspective's Biased Research Is Misleading You About NJ Teacher Pensions. - NJ Left Behind on December 8, 2020 at 11:55 am

[…] Bury of BuryPensions refuted the Herzenberg/NJPP methodology in several 2014 posts (interesting follow up), but even if one agrees with the NJPP’s methodology, pensions […]

Posted by Union Propaganda Misfire | Burypensions Blog on April 27, 2021 at 12:21 pm

[…] 2014 they came out with a report (easily refuted) that claimed “New Jersey ranks close to last for overall pension benefit generosity, at 95th […]